Questa crisi è compatibile con le teorie del credit boom and busts e delle asimmetrie informative. La crise des subprimes en anglais.

Insight/2020/04.2020/04.21.2020_Subprime%20Auto%20Repromotion/Percent%20of%20Balance%2090+%20Days%20Delinquent.png?width=748&name=Percent%20of%20Balance%2090+%20Days%20Delinquent.png)

Are Subprime Auto Abs Still Worth The Risk

Could The 2009 Subprime Mortgage Crisis Have Been Avoided With Blockchain

Subprime Tentacles Of A Crisis Finance Development December 2007

A crise do subprime foi uma crise financeira desencadeada em 24 de julho de 2007 a partir da queda do índice Dow Jones motivada pela concessão de empréstimos hipotecários de alto risco em inglês.

Subprime mortgage 中文. DFS will seek to determine whether the property is subject to a mortgage and if so to identify the party responsible for inspecting securing and maintaining the property in question. Em sentido mais restrito o termo. The higher interest rate is intended to compensate the lender for accepting the greater risk in lending to such borrowers.

Subprime mortgage aux États-Unis à partir de juillet 2007Avec la crise bancaire et financière de lautomne 2008 ces deux phénomènes inaugurent la crise financière mondiale de 2007-2008. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Subprime mortgage crisis est une crise financière qui a touché le secteur des prêts hypothécaires à risque en anglais.

Whats more McDonald and Paulson examined the assertion that the mortgage-backed securities underlying AIGs transactions would not default. A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records. After the crisis there was a claim that these assets had been money-good meaning they were sound investments that may have suffered a decline in the short term but were safe overall McDonald says.

The interest rate on subprime and prime ARMs can rise significantly over time. Historically subprime borrowers were defined as having FICO scores below 600 although this threshold has varied over time. Once identified the Department will contact the responsible party to ensure that it is complying with its obligations under the law.

Subprime mortgage crisis とは2007年末から2009年頃を中心としてアメリカ合衆国で起きた住宅購入用途向けサブプライムローンの不良債権化である. Es ist damit ein Spezialfall eines forderungsbesicherten Wertpapiers englisch asset-backed security abgekürzt ABS. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Le terme sest fait connaitre en français à la suite de la crise des subprimes aux États-Unis. Em sentido amplo subprime do inglês subprime loan ou subprime mortgage é um crédito de risco concedido a um tomador que não oferece garantias suficientes para se beneficiar da taxa de juros mais vantajosa prime rate. Subprime loan ou subprime mortgage prática que arrastou vários bancos para uma situação de insolvência repercutindo fortemente sobre as bolsas de valores de todo o mundo.

These loans are characterized by higher. Kredyt subprime angsubprime loan kredyt bankowy wysokiego ryzyka udzielany kredytobiorcom o niskiej zdolności kredytowej. After reports of the subprime mortgage crisis began to appear in the media which of the following most likely caused housing prices to fall.

August 2007 festgemacht denn an diesem Tag stiegen die Zinsen für Interbankfinanzkredite. Protection of a person building organization or country against threats such as crime or. Kredyty takie pod koniec XX wieku zaczęły być udzielane na wielką skalę w Stanach Zjednoczonych najczęściej udzielane na zakup nieruchomościZałamanie na amerykańskim rynku kredytów hipotecznych subprime w 2007.

Weltfinanzkrise oder globale Finanzkrise bezeichnet eine globale Banken-und Finanzkrise als Teil der Weltwirtschaftskrise ab 2007Die Krise war unter anderem Folge eines spekulativ aufgeblähten Immobilienmarkts Immobilienblase in den USAAls Beginn der Finanzkrise wird der 9. Ein hypothekenbesichertes Wertpapier englisch mortgage-backed security abgekürzt MBS ist eine Anleihe deren Bargeldflüsse durch die Zins- und Tilgungszahlungen eines Pools von grundpfandrechtlich gesicherten Forderungen getragen werden. Credit access declined during the pandemic for credit cards but increased for mortgages and auto loans.

中文 Tiếng Việt. In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people who may have difficulty maintaining the repayment schedule. Pour les créanciers les prêts subprime étaient considérés comme individuellement risqués mais globalement sûrs et rentables.

La crisi è iniziata allincirca nella seconda metà del 2006 quando cominciò a sgonfiarsi la bolla immobiliare statunitense e contemporaneamente molti possessori di mutui subprime divennero insolventi a causa del rialzo dei tassi di interesse. Comparing auto loans for borrowers with subprime credit scores SEP 30 2021. The Home Mortgage Disclosure Act HMDA.

次级住房抵押贷款 搜狗百科

Subprime Mortgage Crisis Wikipedia

Imf Survey Lessons From Subprime Turbulence

Subprime Mortgage Images Stock Photos Vectors Shutterstock

The Financial Crisis Of 2007 08 Trading History Avatrade

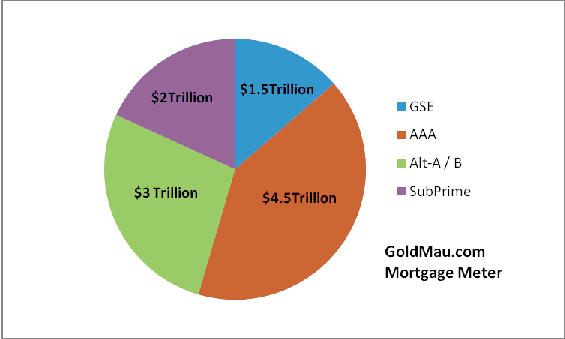

Subprime Home Loans Subprime Currency Gold News

Stressed Borrowers Rattle Resurgent Subprime Lending Industry The New York Times

/GettyImages-172388103-212d7a4ec4954d6fbc84b263111476f2.jpg)

Subprime Mortgage Definition